Freddie’s GMB Mastery: Boosting Loan Volume Without Adding Staff

Once upon a time in the heart of Waco, Texas, there was a subprime lender named Freddie.

Freddie’s loan store, nestled on a bustling street, had always enjoyed modest success.

However, Freddie knew that to truly thrive, he needed to reach more customers who could benefit from his services, especially those facing sudden financial emergencies with limited options.

In the fall of last year, Freddie decided to revamp his Google My Business (GMB) profile, a decision that would pivot his business into a new realm of success.

He meticulously updated every section of his profile, from the business description, emphasizing his compassionate approach to lending, to uploading photos of his welcoming storefront and friendly team.

He even began actively responding to all reviews, fostering a positive community dialogue and building trust.

The changes Freddie implemented were simple yet strategic:

– Enhanced Visibility: By using specific keywords like “subprime loans Waco” and “emergency cash Waco,” he increased his local search rankings significantly.

– Engagement with Customers: Freddie regularly posted updates about new offers and insightful tips on managing finances, which kept his audience engaged and informed.

– Efficient Customer Interaction: The introduction of a booking button on his profile streamlined appointment scheduling, allowing potential clients to easily set up consultations.

By spring, these tweaks to his GMB profile led to a remarkable 22% increase in loan origination volume.

What made this growth even more impressive was that Freddie managed this uptick without the need to hire additional staff.

His existing team absorbed the increased workload efficiently, thanks to improved processes and the automated features provided by GMB.

This not only optimized operations but also kept overhead costs low, maximizing profitability.

Freddie’s story became one of legendary customer service and smart business practices in the Waco community.

His dedication to his clients and his savvy use of online tools turned his modest shop into a bustling hub for financial solutions, helping hundreds manage their financial challenges more effectively.

Your Turn to Shine Like Freddie

Inspired by Freddie’s success?

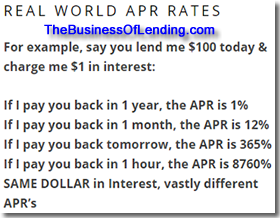

Are you aware that the “Total Addressable Market [TAM] for lending money to strangers is PHENOMINAL?

50%+ of USA working adults live paycheck-to-paycheck!

40% of USA housholds earning $100,000+ live paycheck to paycheck!

You can replicate his achievements in your own subprime lending business.

Whether you’re just starting out or looking to enhance your existing operations, understanding the impact of a well-managed GMB profile is crucial.

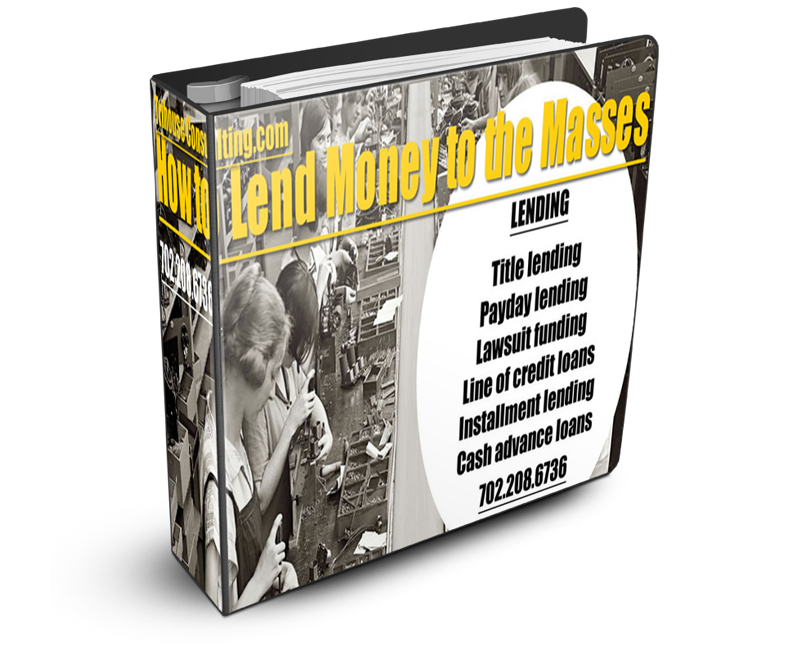

For those eager to dive deeper, I invite you to invest in our 500-page eBook, “How to Loan Money to Strangers.”

This comprehensive guide is packed with industry insights, practical strategies, and real-world examples like Freddie’s to help you navigate the complex world of lending.

Alternatively, schedule a free 15-minute “Brainstorming Session” with me.

Let’s explore tailored strategies to boost your business’s visibility and efficiency, just like Freddie did.

Don’t miss this opportunity to transform your business.

With the right knowledge and tools, you too can achieve remarkable growth without stretching your resources thin.

Join me, and let’s make your business a success story!