loan money to strangers w/o getting your butt handed to you

how to start or improve

a consumer loan business

Payday Loans

Installment loans

car title loans

Learn from the Subprime Lending Gurus at Trihouse Consulting.

Our services

The bible

Our 500-page bible. "How to Loan Money to the Masses without Getting Your Butt Handed to You!"

Consulting

One-on-one, paid hourly sessions. We dive deep into legally sound, high-yield tactics, proven strategies, and operational blueprints to help you scale profitably in the subprime lending space.

Free 15 minute strategy call

Got questions about launching or growing your lending business? Get real answers in a no-cost, 15-minute call. No fluff, no pitch, just expert insight. One conversation could change everything.

Learn from the Subprime LendingGurus

More services

Car Title loans

Texas Cab Model

Launch or turbo-charge your Texas Credit Access Business today.

Our newly updated 2025 CAB/CSO eBook delivers step-by-step licensing checklists, iron-clad contracts, 3rd-party lender hookups, KPI profit levers, SEO domination tactics and legal safeguards proven by million-dollar lenders.

Smash the “Learn More” button and seize your competitive edge now.

Buy/sell scrap gold

Gold is getting a ton of attention! If you’ve been thinking about learning how to buy & sell gold, jewelry, coins, this is a great time to take action.

Learn from the Subprime Lending Gurus

Even More services

Need Capital?

Need capital? We have hundreds of immigrant investors seeking USA greencards and direct investment projects. You have a project?

Ask me anything

Got a question? Let's talk. My A.I. powered Clone is at your service.

I'm ready to answer ALL your questions via my 20+ years lending money to strangers, raising capital, providing expert guidance to online & storefront subprime money lenders.

Be On your borrower's phone

90% of desperate borrowers start on their phones and 63 % choose one of the top-three Google Maps results. If you’re not there, you’re invisible.

Grab our free, power-packed eBook for the exact Google Business Profile blueprint: step-by-step checklists, winning keywords, and compliance-safe tactics subprime lenders use to own the “cash advance near me” search.

More walk-ins, calls, and funded loans start now. Learn More and lock in your front-row spot before competitors do.

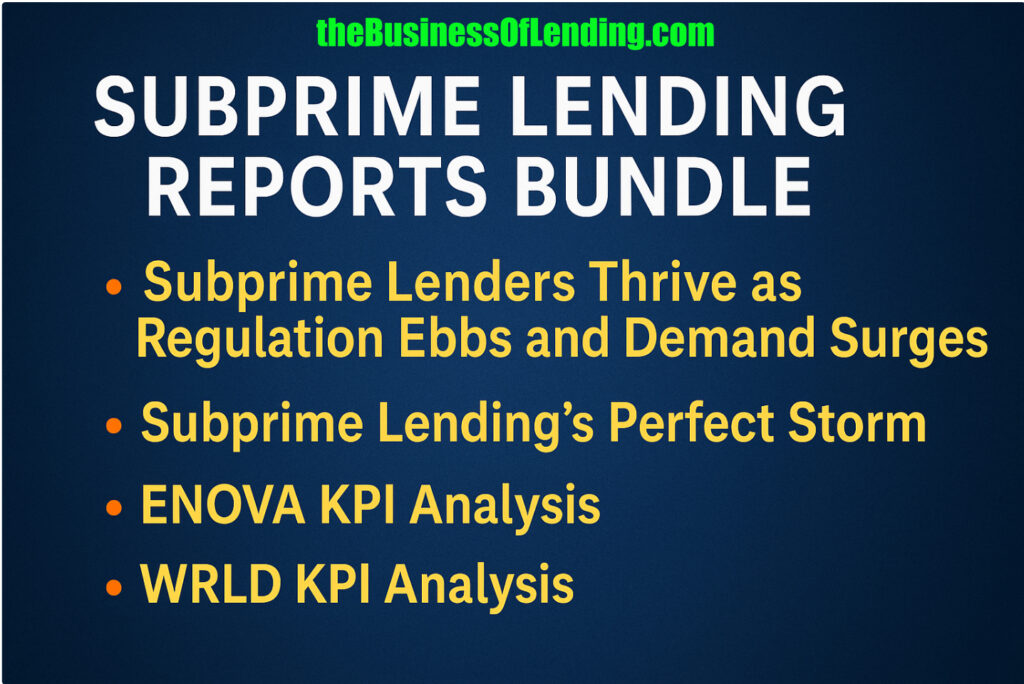

I’ve spent the last 90 days assembling the ultimate subprime lending playbook for 2025/2026.

The data is explosive. The insights are blunt. And the opportunities? Off the charts.

Inside my 3 Report Bundle, you’ll get:

* A macro-level breakdown of why the fall of the CFPB + consumer desperation = your payday.

* A deep dive into the bullish case for storefront and online lenders, with real metrics from market leaders.

*How a 100% digital lender is printing money with zero branches.

* How a legacy branch-based operator is quietly staging a powerful comeback.

It’s the only cheat sheet you need to dominate the subprime landscape in 2025/2026.

Trihouse Consulting | Services Snapshot

Rapid-Fire Strategy Calls – Book a 15-minute “ask-me-anything” session (or extend as needed) for on-the-spot answers about licensing, tech, capital, or deal flow. thebusinessoflending.com

Hands-On Advisory & In-Store Training – Phone, Zoom, on-site, or even a day working inside our Texas loan store—engagements flex to match your launch or scale-up goals. thebusinessoflending.com

Done-For-You Playbooks & Tools – Instant-download manuals (the 500-page “Bible”), Texas CAB blueprint, state-by-state car-title analysis, and interactive pro-forma models that shortcut months of trial and error. thebusinessoflending.comthebusinessoflending.com

Regulatory & Compliance Navigation – End-to-end guidance on Texas CAB structuring, sovereign tribal partnerships, sample contracts, and lender introductions. thebusinessoflending.comthebusinessoflending.com

Marketing & Lead-Gen Accelerators – My Google Business Profile blueprint puts your store on borrowers’ phones—no 36%-APR ad hurdle required. thebusinessoflending.com

Boot Camps & Keynotes – High-energy workshops and conference presentations that transfer 20+ years of front-line lending know-how to your entire team. thebusinessoflending.com

Ready to move? Reply to this email or call 702-208-6736 and let’s tailor a plan that fits your timeline, complexity, and ambition.

Launch & Scale Your Subprime Lending Empire

Welcome!

I’m Jer [short for Jerome] of Trihouse Consulting, the ~20-year “go-to guru” for entrepreneurs, VC-backed fintechs, family offices, and legacy storefront operators who want to start a payday loan business, add car-title loans, expand into installment loans, or roll out a profitable line-of-credit product online, on mobile, and in-store.

If you searched “how to start a loan business,” you just found the partner who has personally guided more than 300 subprime lenders to licensing, launch, and scalable profit.

Why Lenders Trust Me

Regulatory Sherpa – I translate complex state statutes, OCC rules, and tribal codes into a clear playbook you can act on today.

Operational Architect – From loan-management-system (LMS) selection to ACH/card rails, collections scripts, and KPI dashboards, I build the engine that prints predictable cash flow.

SEO & Lead-Gen Strategist – Google’s latest “Payday Loan” algorithm punishes spammy sites; my white-hat content and backlink plan attracts qualified borrowers and keeps you penalty-free.

Network Effect – Processors, surety-bond brokers, program attorneys, high-risk merchant banks, if subprime lenders need it, it’s already in my Rolodex.

The Problems I Solve

“I need a blueprint for launching my payday loan startup.”

“Compliance headaches and 36 % rate caps are squeezing my storefront margins.”

“My online installment-loan traffic is tanking, help me rank again.”

“Investors want proof we can scale a $50 M receivables book without blowing up defaults.”

I fix all four, FAST!

My 4-Pillar Framework

1. Plan & License

Entity choice (state, tribe, offshore)

Surety bonds & MLO registrations

Policy & procedures manuals

2. Capitalize & Underwrite

Warehouse-line introductions

Data-driven scoring for thin-file, “banked-but-bounced” borrowers

Stress-testing against <36 % APR scenarios

3. Acquire & Convert

SEO pillars targeting “payday loans near me,” “online title loans,” “bad-credit installment loans”

Omni-channel funnels: SMS, push, live chat, IVR

Google-compliant ad copy that sidesteps “loan shark” filters

4. Optimize & Exit

AI-assisted collections to cut roll rates 50 %

Portfolio sale strategy at 2–4× book value

Data room prep for private-equity diligence

| Objective | Result | Timeframe |

|---|---|---|

| Obtain first state license | Approval & bonds in place | 15–60 days |

| Start a payday loan business online | Site live, LMS integrated, ACH funding | 45 days |

| Add car-title loans to storefront | Collateral process & DMV lien flows | 30 days |

| Turn on line-of-credit product | Revolving module + card issuance | 45 days |

| Rank page-one for “installment loans online” | Organic top-5 position | 90 days |

Proof in the Numbers

- 28 % store-level profit within nine months (Dallas, TX)

- $12 M deployed first year by a Midwest family office

- 8,000 loans/month processed on a two-person ops team

- Default losses ↓ 50 % after deploying my machine-learning collections model

Compliance Without Compromise

My guidance keeps you ahead of OCC “True Lender” memos, CFPB supervision [Thanks to President Trump DEAD today, but who knows what the future holds], and every state-level APR cap.

I also reverse-engineer algorithm updates so your content stays evergreen, even as Google tightens the screws on “payday loan” keyword abuse.

Ready to Dominate Subprime Lending?

- Book a free 15-minute strategy call to walk away with a personalized launch timeline.

- Download my 25-point Compliance Checklist –free, instant PDF.

- Join the Trihouse Inner Circle for weekly deal flow, vendor discounts, and live Q&A.

“Trihouse transformed my side hustle into a multi-state lender with a $50 M receivables book.” – Nadine Carter, Vendor

Your borrowers are one unexpected expense away from needing fast, fair cash. Let’s make sure your brand is the first and most trusted answer when they search.

Click “Start Now.” I’ll show you exactly how to start or improve your consumer-lending business and claim the No. 1 spot on Google while we’re at it.

Turn curiosity into cash. My ~500 page Manual, “How to Loan Money to the Masses without Getting Your Butt Handed to You!,” packs 20 years of subprime know-how into one blunt, actionable playbook.

Licensing, ACH automation, default crushers, 36 % cap work-arounds… every tactic top lenders use to pull double-digit returns is right here.

Download today and get the same checklists my five-figure clients guard like gold delivered in minutes.

If it doesn’t pay for itself on your first loan, I’ll refund you and gift an hour of consulting. Hit Start Now and stake your claim.

Copy from ChatGPT: High-Intent Keywords We Target (& You Just Read)

Core | Expansion | Long-Tail |

how to start a payday loan business | subprime lending consultant | “small-dollar loans compliance checklist” |

how to start a loan business | payday loan licensing | “best LMS for payday lenders” |

consumer lending business startup | car title loan software | “tribal lending model guide” |

online installment loans | line of credit loans | “reduce default rate payday loans” |

subprime loan marketing | high-risk payment processing | “SEO for payday lenders 2025” |

These phrases align with the People Also Ask data and competitive gap analysis the SEO industry recommends for payday-loan sites SJ Digital Solutions. Embedding them naturally across headings, alt text, and internal links lifts topical authority without tripping Google’s spam thresholds.