Bank Overdraft Limits: The Golden Window for Subprime Lenders

The finalized rule from the CFPB, capping overdraft fees and reclassifying some as loans, will significantly impact both traditional banks and the subprime lending industry. Here’s a detailed analysis: Overview of the Legislation Options for Fees: Banks can now: Charge a flat fee of $5. Charge fees to cover costs/losses. Structure fees as disclosed loans, […]

When Rules Backfire: The Unintended Fallout of APR Caps on Subprime Borrowers

When well-meaning regulations collide with the realities of financial need, the fallout can be as unexpected as it is impactful. Imagine Joe, a single parent caught off-guard by a medical emergency seeking a $500 loan to cover urgent expenses. Now, picture the lender, bound by a 36% APR cap, trying to offer that help while […]

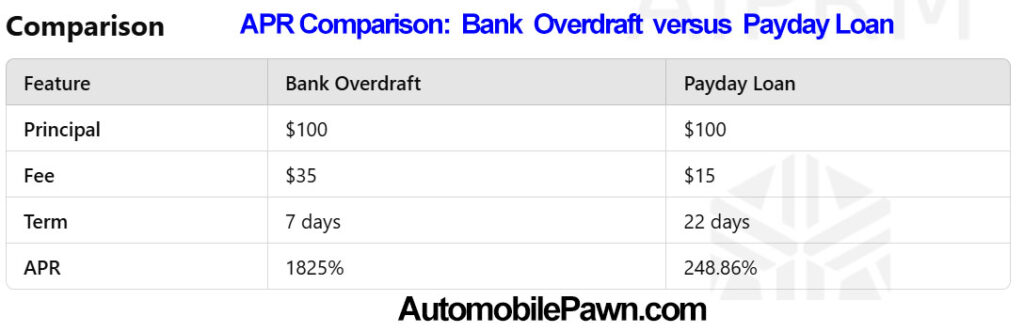

The Truth About State-Imposed 36% APR Caps

By: Jer Ayles – Trihouse Consulting. The continuing trend of states imposing a 36% APR cap on payday loans is touted as a consumer protection measure. However, this well-intentioned policy has unintended consequences that actually harms the very people it aims to help. Let’s explore why payday loan products are better than the state implementing […]

Must-Read: The Hidden Consequences of the Senate’s 36% APR Loan Cap Bill!

Predatory Lending Elimination Act (S. 3549) Analyzing the Impact of the Proposed 36% APR Cap on Consumer Loans IntroductionThe U.S. Senate is considering a significant legislative move that could redefine the consumer lending landscape in America. The “Predatory Lending Elimination Act” seeks to implement a nationwide 36% annual percentage rate (APR) cap on all loan […]