By: Jer Ayles. Consiglieri to entrepreneurs interested in “The Business of Lending to the Masses.”

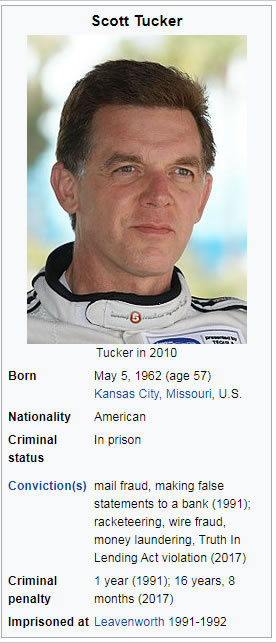

Scott Tucker has been portrayed by Netflix, American Greed, The WSJ, The NYT… and on and on as a pure, 100% scum bag payday loan lender and loan shark for years. When I speak to investors, Wall Street, Family Offices, reporters, employees and peers, the name “Scott Tucker” is always part of the conversation.

Below, I give you your opportunity to hear directly from Scott. In his own words, you will gain insight into his side of his story. No matter your preconceived thoughts about Scott Tucker and his payday loan business escapades, the interview below will most likely change your mind in some respects and inform you as to the lengths our government will go should they choose to make an example of you! [NOTE: BOOKMARK THIS PAGE in order to listen to all 5 podcasts!]

No doubt about it, Scott employed some pretty outrageous business practices. Scott has a big ego and he pushes life and business to the limit!

And, as we all now know, so do the FED’s.

Scott did a 2.5-hour interview with a white-collar criminal consultancy group focused on helping defendants in criminal cases prepare for sentencing, prepare for prison, and prepare for the best possible outcomes. [Link below.]

I know the payday loan space very well. I know Scott Tucker.

I too opened my first location in 1998. There were “rules” and “best practices” and yet it’s true that there was a bit of a “wild west” mindset in the early days of payday loan lending. The industry grew from virtually zero to billions of dollars in funded loans overnight!

Borrow $100 and two weeks later, payback $115. No big deal. Currently, 14M to 20M+ USA customers use payday loans, installment loans, and car title loans to solve their financial challenges. [Imagine China, Brazil, India small-dollar loan volume!] It was simple for an entrepreneur to scrape together $10K – $50K, open a little payday loan store in a strip mall and start handing out money to people! You had no clue if they would honor their agreement with you and pay you back. Collections! Ugh!!

IT WAS NUTS!

Some of us made MILLIONS of DOLLARS doing this! Others went broke! And a few, like Scott Tucker, went to jail! Scott was a pioneer who pushes everything in life to the limit! His downfall? Ego? His pioneering implementation of the “tribe model” after the alleged consumer abuse claimed by the FED’s had occurred? The FED’s decided to make an example of him? Likely a combination…

[NOTE: That the “tribe model” has matured vastly since the so-called “Scott Tucker days!” The combination of $Capital + sovereign federally recognized Native American Indian Tribes + sophisticated technology and extremely positive outcomes in the Courts supporting the tribal lending model have resulted in tremendous advances in the stability of the “sovereign model.” I’ve participated in tribe portfolios and consulted for multiple entrepreneurs who have successfully and lawfully scaled minimal capital infusions in collaboration with Indian Country to achieve $50M+ loan portfolios in just a few years! Small-dollar loans averaging $300 – $800 with 400%+ APR’s. Click here to learn more about the Tribe Model.]

Boy how things have changed! And yet today, it’s still easy to start a consumer loan business LAWFULLY!

How do I know this?

- The laws and regulations are more clearly defined.

- Demand by consumers for small-dollar loans increases daily. [Simply review the Quarterly Reports for CURO/SPEEDY, ENOVA, ONEMAIN

Each of these companies reported over $1 Billion dollars in loans last year! We’re talking small-dollar loans… often averaging $300- $800+!] - Today, there is a multitude of financial products and services for the so-called underbanked/unbanked/subprime as a result of the fact that nearly half of all U.S. households cannot access $1000 cash in an emergency. Approximately 40% can’t access $400 cash in an emergency!

- A suite of 3rd party vendors can be assembled by a Lender who chooses to enter this “business of lending to the masses.” Within weeks, an entrepreneur can secure a State/Province license if required, select a loan management software company to automate the business, connect with consumer identification underwriters, gain instant visibility on a borrower applicant’s bank account [IBV: Instant Bank Account Verification], employment and cell phone carrier history, employer and residence patterns, determine if the borrower applicant already has outstanding payday and/or car title loans… Lenders today know if their loan applicant just visited Starbucks!

- Frankly, it’s astounding how much data is available to a Lender today! Loan decisioning in 90 seconds! Same-day funding! Online or in a storefront environment. AI is certain to vastly reduce a Lender’s dependence on call center services if not eliminate completely.

SCARY! In these United States of America today, millions of folks must have access to a few hundred dollars for everyday emergencies!!

The single-payment “payday loan product” is rapidly becoming a dinosaur. However, demand for quick, easy access to a few hundred dollars is going nowhere but UP! Demand continues to increase all over the world. Moneylenders and the ordinary folks who need them have been around since the beginning. Read “Debt: The First 5000 Years” and “The Ascent of Money” for perspective. Two excellent books and highly recommended on the history of money lending.

But as in every industry, there are outliers. Both consumers and business executives who test the limits of common sense and fairness. Fraudsters and thieves.

Example: There was a phone sex call center in my first payday loan location’s building; 100+ female employees. [This was way back in the days of the 1-900 premium pay-per-call business models. “Call 1-900-XXX-XXX to talk to a psychic hotline, adult chat lines…] 20% of these ladies hit up my payday loan store every week. I’d give them $255. Two weeks later, they owed me $300. 70% paid me back as promised. My Team spent our time chasing down the 30% who tried to blow us off. 🙂

Banks & credit unions in my area? They did not like me! They did not like my customers.

But they did like the $35 NSF fees my payday loan customers were avoiding by doing business with me.

I know, dear reader… you’re first thought! My conscious? How could I be a money lender? Profiting off the backs of these poor sex workers! Scum bag!!

- One lady needed an abscessed tooth fixed. I loaned her the cash to get it taken care of. [Remember this is early 1998 when $255 was really $255!]

- One lady needed a prescription filled. We helped her…

- One lady’s car broke down. She couldn’t get to work. We loaned her the cash…

- I recall a phone sex worker who borrowed $255. Then, every two weeks we tracked her down for our $255. She never had it. She chose to pay us our $45 fee instead and “rollover” her payday loan. This went on for 10 pay periods [so… we collected $450 over 20 weeks]. Don’t think this was easy. She dodged us EVERY payday and would NOT respond to calls, letters… Eventually, I reviewed her transactions. We loaned her $255. She had paid us $450. As she sat at my desk, I told her she had paid enough and I literally tore up her contract. “We are done.” I learned later, from a buddy of mine who owned a payday loan store about 5 miles from me, that she was, and continues to get payday loans from his store.

- On the other hand, I had a client who borrowed $3000 2 to 3 times/year using his truck as collateral; a “car title loan.” There were times when he had to make payroll or buy supplies for a construction job he had just “landed.” He’d pay us back $3240 for a 30 day $3000 loan. [We charged him 8%/month.] No worries!

Today, I have equity in stores and online platforms in multiple states and via Native American Indian tribes. I’m an investor in several internet lending platforms and Silicon Valley startups. I offer consulting services for entrepreneurs, venture capitalists, family offices, investors, and existing operators in need of help.

MOST IMPORTANTLY, I’m a conduit for all parties interested in “the business of lending to the masses.” My Team operates several websites & Blogs dedicated to “the business of lending money to the masses” profitably.

Additionally, I give and support several charities!

Jer – TheBusinessOfLending.com

Reach out! Cell = 702-208-6736 Email: TrihouseConsulting@gmail.com

Ready and able to explore the business of lending to the masses! Fintech, workplace advances, car title loans, installment lending, payday loans… CLICK HERE TO LEARN MORE

And no, unlike Scott Tucker, I am not a billionaire. And apparently, Scott no longer is either.

From the Podcast: “Scott Tucker built a billion-dollar business. He started with a single storefront. In this episode, the third episode in a multi-part series, we learn how.

Despite his not being a good student, Scott Tucker always had ambition. Like many young entrepreneurs, he started with lawn mowing businesses that he launched as a child. While in college, Scott found an opportunity to get involved in real estate. Scouring the classified ads, he secured an opportunity that netted him more than $100,000 for six months’ work. Then he invested those resources to build other businesses.

After a brief period in the car business, Scott discovered a new market. People were asking if they could provide him with a post-dated check for a deposit. They needed a bit of liquidity until they received a paycheck.

Scott decided to start a company. People could write a post-dated check for $120. It would not be good until the person’s payday. Scott would give the person $100 in exchange for that post-dated check. That was how the payday loan business began.

Scott said that 1 out of 3 people who borrowed money for the first time chose not to repay the money. The business model had to build profits that would cover those anticipated losses. The strategy he deployed resulted in massive growth for the industry. It also resulted in massive amounts of revenues for his company and employment for thousands of people.

Unfortunately, the government did not like the industry. Scott went through numerous trials. As described in the first episodes of this series, a jury convicted Scott of violating various federal laws. It’s a white-collar crime, but he faces decades in prison.”

Interview #1

Interview #2

Interview #3

Interview #4

Interview #5