Goeasy Ltd. Reports Results for the Fourth Quarter and Full Year

& Announces Increase to Automotive Securitization Facility

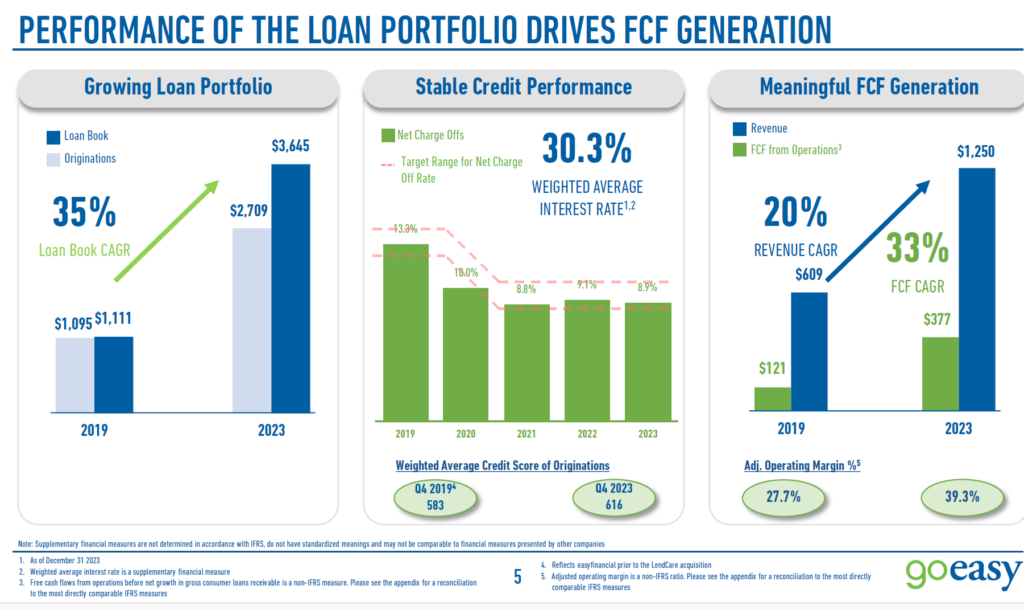

Quarterly Loan Originations of $705 million, up 12% from $632 million

Loan Portfolio of $3.65 billion, up 30% from $2.79 billion

Quarterly Net Charge Off Rate of 8.8%, down 20 bps from 9.0%

Quarterly Diluted EPS of $4.34, up 154%;

Adjusted Quarterly Diluted EPS1 of $4.01, up 32% from $3.05

Annual Diluted EPS of $14.48, up 72%;

Adjusted Annual Diluted EPS1 of $14.21, up 23% from $11.55

Annual Dividend per Share Increased to $4.68, up 22% from $3.84

Let’s delve into Goeasy LTD’s March 2024 and Q4 2023 financial performance, key findings, background, and some insights based on the data available in these Goeasy documents.

Background and Overview:

Goeasy Ltd is a Canadian company specializing in offering high-interest loans to consumers who typically do not qualify for traditional bank loans.

Their services include both secured and unsecured consumer loans, with a strategic focus on underbanked or credit-challenged individuals.

Goeasy also leverages a network of retail locations alongside a robust online platform to service their loans.

Financial Performance Highlights

Q4 2023

– Revenue Growth: Goeasy reported a significant increase in revenue compared to Q4 2022, largely due to increased loan originations which reflect a continuing demand for non-prime consumer credit.

– Net Income: There was a notable improvement in net income, driven by better loan performance and cost management.

– Loan Book Quality: The loan book showed resilience with reduced delinquency rates, thanks to enhanced credit assessment techniques.

March 2024

– Annual Performance: The annual report reflects a sustained increase in revenue year-over-year, with a robust growth in both secured and unsecured loan portfolios.

– Operational Efficiency: Operating expenses as a percentage of revenue have decreased, indicating improved operational efficiency.

– Expansion: Goeasy has expanded its market reach by opening new branches and enhancing its digital platform to accommodate a broader demographic.

Key Takeaways

– Steady Growth: Goeasy Ltd has shown consistent financial growth, underscoring the effectiveness of their business model in the subprime lending market.

– Operational Resilience: Operational improvements have contributed to a lower cost structure, making the company more resilient against economic fluctuations.

– Credit Risk Management: Enhanced credit scoring and risk management practices have resulted in a healthier loan book with fewer delinquencies.

Strategic Insights

– Market Position: Goeasy’s focus on technology and customer service continues to solidify its position in the market as a preferred lender for non-prime consumers.

– Investment in Technology: Continuous investment in digital platforms is critical, especially to cater to the younger demographic and improve the customer loan management process.

– Regulatory Environment: Staying ahead of regulatory changes and maintaining a proactive approach towards compliance is vital for sustaining growth and mitigating risks.

Goeasy is likely to continue benefiting from the expanding market demand for alternative financing solutions.

However, they must remain vigilant about potential economic downturns that could affect their customer base’s ability to repay loans.

By harnessing advanced analytics for better risk assessment and exploring new market segments, Goeasy can potentially enhance its growth trajectory and profitability in the coming years.

The strategy should also include a strong focus on customer education and financial literacy to reduce default risks and foster customer loyalty.

Overall, Goeasy Ltd’s financial health appears robust, with effective strategies in place to navigate the challenges and opportunities of the subprime lending market.