The Controversial Truth About Payday Loans: Necessary Evil or Predatory Trap?

Doris James, a hardworking single mother of two, never imagined she would find herself in a financial crisis.

With a stable job as a cashier, she managed to make ends meet each month. But when her youngest child fell ill and required expensive medical prescriptions, Doris’s savings were quickly depleted.

Facing mounting medical bills, Doris reached out to family and friends to no avail. They were all tapped out.

Doris then turned to her church. Again, her church couldn’t help. So many of the parishioners were facing their own financial catastrophies; many iving in their cars. [More than a few no longer owned a car!]

Ultimately, having no other immediate options, Doris turned to a payday loan for help.

For Doris, the payday loan seemed like a lifeline. It provided her with the immediate cash she needed to cover her child’s medical expenses.

However, as weeks turned into months, Doris found herself struggling to repay the loan. The high interest rates and additional fees quickly turned her initial relief into a relentless cycle of debt.

The payday loan industry is often painted in broad strokes as predatory and exploitative, but the reality, as Doris’s story illustrates, is far more complex.

Are payday loans a necessary financial tool for those with no other options, or do they perpetuate a cycle of debt that traps the most vulnerable?

Let’s dive into the facts and the controversy surrounding payday loans.

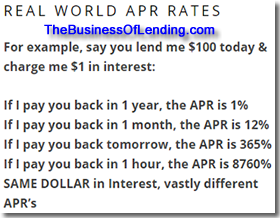

The image provided by TheBusinessOfLending.com highlights a critical point about APR calculations: they can be misleading when applied to short-term loans like payday loans.

For instance, borrowing $100 and paying $1 in interest results in vastly different APRs depending on the repayment period.

If repaid in a year, the APR is 1%. However, if repaid in an hour, the APR skyrockets to 8760%.

This calculation exaggerates the cost of payday loans when viewed over an extended period, such as 52 weeks, assuming continuous rollovers.

To illustrate this fallacy, consider the scenario of taking a taxi from New York to Los Angeles.

Such a journey, intended for short distances, would be exorbitantly expensive and impractical when stretched over a long distance.

Similarly, renting a hotel room nightly for an entire year would be far more costly than a monthly rental agreement.

These examples show that certain services are designed for short-term use, and their costs appear disproportionately high when extended beyond their intended duration.

Therefore, comparing payday loan APRs over a full year without considering their short-term design misrepresents their actual cost.

Payday loans are meant to provide quick financial relief, not long-term financial solutions.

Just as a taxi ride or nightly hotel stay is not intended for long-term use, payday loans should be evaluated within their appropriate context.

This comparison underscores that payday loan APRs, while seemingly high, are subject to interpretation and should be understood within the framework of short-term borrowing.

The Case for Payday Loans

1. Accessibility for the Credit-Challenged

Payday loans provide quick and easy access to cash for individuals who might not qualify for traditional loans due to poor credit histories.

This accessibility can be a critical lifeline during financial emergencies, such as unexpected medical bills or urgent car repairs.

2. Speed and Convenience

The application process for payday loans is typically fast, with many lenders offering same-day approval and funding.

This speed is vital for those who need money immediately and cannot afford to wait for a traditional loan approval process.

3. No Need for Credit History

Payday lenders do not require a strong credit history, making these loans accessible to a broader demographic.

This inclusivity ensures that even those who have made financial mistakes in the past can access the funds they need.

4. Regulation and Transparency

Contrary to popular belief, the payday loan industry is regulated both at the state and federal level.

For instance, in Texas, the Office of Consumer Credit Commissioner (OCCC) monitors payday lenders to ensure compliance with state laws. Fees and terms are disclosed upfront, providing transparency that helps consumers make informed decisions.

The Predatory Argument

1. Exorbitant Interest Rates

Critics argue that the high interest rates charged by payday lenders are exploitative. For example, a typical payday loan can carry an annual percentage rate (APR) of over 400%【7†source】. Such rates can make it difficult for borrowers to repay the loan, leading to a cycle of debt.

2. Debt Traps

Many payday loan borrowers need more time to repay the initial loan, leading to rollovers and additional fees. This cycle can trap borrowers in a continuous debt loop, with each new loan taken out to repay the previous one.

3. Targeting the Vulnerable

Payday lenders often target low-income individuals who are already struggling financially. The easy availability of these loans can lead borrowers to make poor financial decisions, exacerbating their financial woes.

4. Lack of Long-Term Solutions

While payday loans provide short-term relief, they do not address the underlying financial issues that lead individuals to need such loans in the first place. This lack of a long-term solution can leave borrowers in a worse financial position than before.

Counterarguments to the Criticism

1. Regulation Mitigates Abuse

The argument that payday loans are unregulated and predatory does not hold in states like Texas, where the OCCC ensures that lenders comply with strict guidelines. Transparency in fees and terms allows borrowers to understand the costs involved.

2. Financial Literacy is Key

The cycle of debt often results from a lack of financial literacy rather than the loan itself. Increasing financial education can help borrowers make better decisions and use payday loans responsibly.

3. Not All Borrowers Fall into Debt Traps

Many payday loan borrowers use these loans responsibly and repay them on time. These loans can provide a crucial stopgap during financial emergencies without leading to long-term debt for all users.

4. Alternatives are Limited

For many individuals, payday loans are the only available option. Traditional banks and credit unions often turn away those with poor credit, leaving payday lenders as the only source of quick cash.

Conclusion

The payday loan industry is undoubtedly controversial, with strong arguments on both sides.

While it is essential to recognize the potential for exploitation and the need for regulation, it is equally important to acknowledge the role payday loans play in providing critical financial access to those who need it most.

Instead of vilifying payday loans outright, a more balanced approach involving regulation, transparency, and financial education could help ensure these loans serve their intended purpose without trapping borrowers in a cycle of debt.

What do you think? Are payday loans a necessary evil or a predatory trap? Share your thoughts in the comments below!

4-WAYS I CAN HELP YOU!

Grab a copy of our “bible:” Learn More

Brainstorm: Learn More

The Business of Lending: Learn More

Free Bi-Monthly Newsletter: Learn More