California Payday Loan Laws and Regulations

Get our free industry Newsletter Imagine this: legally charging fees that translate to over 400% APR on short-term loans. In California, this isn’t just possible—it’s the reality for payday loans under the Deferred Deposit Transaction Law (DDTL). For subprime lenders like you, this is a golden window of opportunity, with state laws allowing maximum fees of 15% […]

What Should a Subprime Lender Do to Prepare for the Small Dollar Loan Rule (SDLR)?

Imagine a regulatory storm that could shutter one in three subprime lenders by 2026 unless they act decisively before March 30, 2025. The CFPB’s Small Dollar Lending Rule isn’t merely a compliance checkbox; it’s a seismic shift in how America’s $50B high-risk credit market operates. For lenders who survive this upheaval, there’s profit. For those who […]

Subprime Lenders, Beware: Why a Defunct CFPB Might Strike Harder Than You Think

Despite the CFPB’s sudden defunding and the current lull in regulatory enforcement, subprime lenders should view this as a brief reprieve rather than a permanent victory. The Small Dollar Rule and its core consumer protection provisions could be reactivated at any time, either through a revived CFPB or another federal authority stepping into the void. […]

Bank Overdrafts: The Real Credit Sharks Exposed

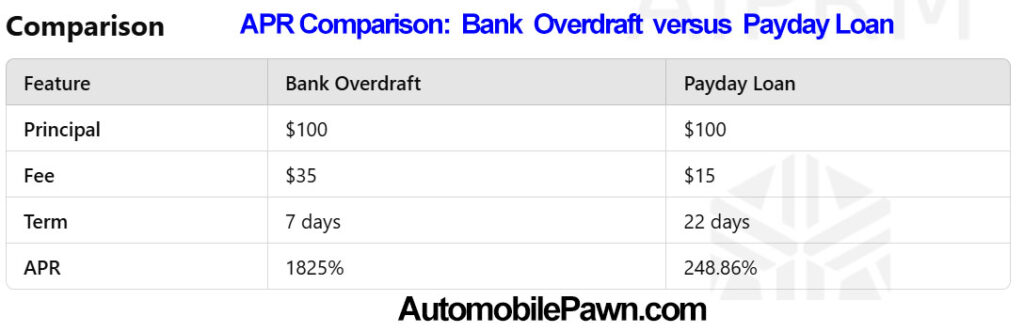

Enough said! I’m annoyed 😠 To Critics of Subprime loans and their APRs – Let’s Ground this Debate in Reality. Why Legislators Are Wrong About Subprime Lending—and How It Affects You Cost vs. Alternatives: As the table below shows, a $100 payday loan with a $15 fee over 22 days results in an APR of […]

Breaking: FCC Gives Subprime Lenders a One-Year Reprieve—But at What Cost?

The Federal Communications Commission (FCC) has announced a one-year postponement of its one-to-one consent rule, shifting the implementation date from January 27, 2025, to January 26, 2026. This delay provides subprime lenders with valuable time to adjust their practices and understand the implications of this significant regulatory change. The rule requires payday loan, car title […]

President Trump’s Reelection: A Turning Point for Consumer Lending?

The subprime consumer lending industry stands on the brink of significant transformation, with President Trump’s reelection guaranteed to be a powerful catalyst for change. Should his administration’s policies gain traction, they will create substantial opportunities and notable challenges for lenders, reshaping the subprime credit and financial services landscape. THE FACTS: 6 in 10 USA consumers […]

🌟 Meet Kim: The Customer Service Powerhouse You’ve Been Searching For! 🌟

With nearly 15 years of experience in the subprime lending industry – payday, installment, cash advance and auto title loan industry, Kim isn’t just a customer service representative—she’s the secret ingredient for business growth and customer retention. Based in Fort Worth, Texas, and seeking a remote opportunity, Kim combines warmth, humor, and a unique knack […]

The Dave.com Trap: A Blueprint for Ethical and Profitable Subprime Lending

Executive Summary: A Wake-Up Call for Subprime Lenders Subprime Dave Inc., a trailblazer in the online cash advance industry, now finds itself in the crosshairs of regulatory bodies like the FTC and Justice Department. Accusations of deceptive marketing, hidden fees, and ethical missteps have laid bare not just the company’s practices but systemic vulnerabilities in […]

Bank Overdraft Limits: The Golden Window for Subprime Lenders

The finalized rule from the CFPB, capping overdraft fees and reclassifying some as loans, will significantly impact both traditional banks and the subprime lending industry. Here’s a detailed analysis: Overview of the Legislation Options for Fees: Banks can now: Charge a flat fee of $5. Charge fees to cover costs/losses. Structure fees as disclosed loans, […]